Gallery

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)The Badminton Association of India (BAI) has announced a 14-member-strong India squad for

- Men’s Sr Hockey Nationals to be played in division-based format from April 4

- Mensik denies Djokovic 100th title in Miami final

- KIPG: Son of a vegetable vendor, Bihar’s Jhandu Kumar eyes Worlds, 2028 Paralympics

- Hardik Singh credits hard work and team unity for receiving HI Midfielder of the Year award

- Djokovic, Alcaraz land in same half of Miami draw

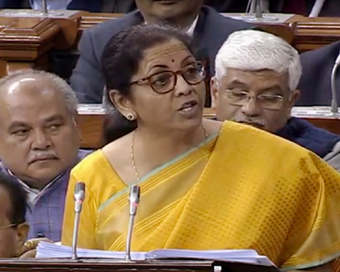

Income tax rates, slabs changed; those earning up to Rs 15 lakh benefit Last Updated : 01 Feb 2020 03:40:34 PM IST

FM Nirmala Sitharaman In a major relief to middle class, Finance Minister Nirmala Sitharaman has proposed to cut income tax rates and change slabs to lower tax incidence for those earning upto Rs 15 lakh a year.

The Minister has proposed a 10 per cent tax on income between Rs 5 lakh and Rs 7.5 lakh from the current 20 per cent now.Income between Rs 7.5 lakh to Rs 10 lakh will also attract a lower tax of 15 per cent. For annual income between Rs 10 lakh and Rs 12.5 lakh, the income tax rate has been reduced to 20 per cent from 30 per cent.Those earning Rs 12.5 lakhs to Rs 15 lakhs will pay 25 per cent tax. The Finance Minister said that those earning over Rs 15 lakh would continue to pay the tax at the current rate of 30 per cent."A person earning Rs 15 lakh per annum and not availing any deductions will now pay Rs 1.95 lakh tax in place of Rs 2.73 lakh," the Finance Minister said while presenting her second Union budget in the Lok Sabha.Terming the new tax rates and slabs as simplified one, she said that the new reduced rates would apply for those who agree to forego all other exemptions available under the Income Tax Act.At present, those earning upto Rs 2.5 lakh a year are exempted from income tax. The current income tax rate for those earning from Rs 2.5 lakh to Rs 5 lakh is 5 per cent but availing the deductions and exemptions, they can bring down their tax liability to nil.The reduction in tax rates is set to boost sentiments and add to the purchasing power of the people. The measures are aimed at addressing the demand side concerns.On account of lower income tax rates, the government would forego a total revenue of Rs 40,000 crore in a year.Many experts had earlier said that most measures announced by the government to boost the eco

IANS New Delhi For Latest Updates Please-

Join us on

Follow us on

172.31.16.186