Gallery

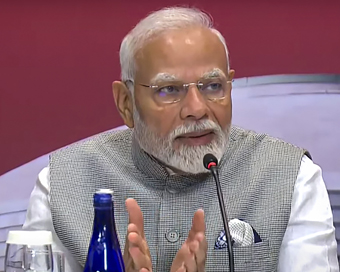

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)The Badminton Association of India (BAI) has announced a 14-member-strong India squad for

- Men’s Sr Hockey Nationals to be played in division-based format from April 4

- Mensik denies Djokovic 100th title in Miami final

- KIPG: Son of a vegetable vendor, Bihar’s Jhandu Kumar eyes Worlds, 2028 Paralympics

- Hardik Singh credits hard work and team unity for receiving HI Midfielder of the Year award

- Djokovic, Alcaraz land in same half of Miami draw

Union Cabinet approves Yes Bank reconstruction scheme Last Updated : 13 Mar 2020 04:32:43 PM IST

Union Cabinet meet The Union Cabinet on Friday approved a reconstruction plan for cash-strapped Yes Bank, under which the State Bank of India will pick up 49 per cent of the equity, while private investors will be allowed to buy the rest.

According to Finance Minister Nirmala Sitharaman, the Cabinet decided that the SBI will hold at least 26 per cent stake in the private bank for a minimum period of three years. Similarly, the other investors will also be mandated to have a similar lock-in period for 75 per cent of their investment in the bank.The authorised share capital of the Yes Bank will be revised upwards from Rs 1,100 crore to Rs 6,200 crore.Besides, Sitharaman indicated that the details of the scheme will be notified soon.She further said that Yes Bank's moratorium will be lifted at 16.00 hours, after three working days of the scheme being notified.The office of the administrator shall also stand vacated after seven days from the cessation of moratorium and the new Board will take over the bank.Prashant Kumar, former SBI CFO, is the current administrator.In addition, she said, the new Board will have two members from the SBI.IANS New Delhi For Latest Updates Please-

Join us on

Follow us on

172.31.16.186