Gallery

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)The Badminton Association of India (BAI) has announced a 14-member-strong India squad for

- Men’s Sr Hockey Nationals to be played in division-based format from April 4

- Mensik denies Djokovic 100th title in Miami final

- KIPG: Son of a vegetable vendor, Bihar’s Jhandu Kumar eyes Worlds, 2028 Paralympics

- Hardik Singh credits hard work and team unity for receiving HI Midfielder of the Year award

- Djokovic, Alcaraz land in same half of Miami draw

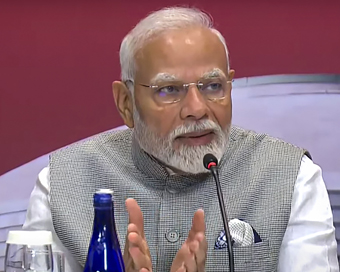

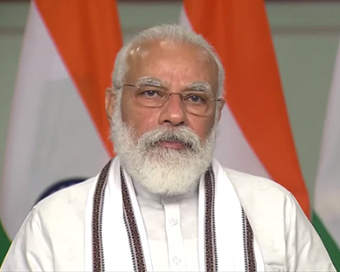

PM Modi discusses credit growth, risk aversion with banks, NBFCs Last Updated : 30 Jul 2020 12:15:20 AM IST

Prime Minister Narendra Modi Prime Minister Narendra Modi on Wednesday held a meeting with the stakeholders of banks and NBFCs and discussed issues in the financial sector, including credit growth and risk aversion.

The meeting largely talked about the vision and roadmap for the future.A statement from the Prime Minister's Office (PMO) said that the crucial role of the financial and banking system of supporting growth was discussed. It was noted that the small entrepreneurs, SHGs and farmers should be motivated to use institutional credit to meet their credit needs and grow."Each bank needs to introspect and take a relook at its practices to ensure stable credit growth. Banks should not treat all proposals with the same yardstick and need to distinguish and identify bankable proposals and to ensure that they get access to funding on their merit and don't suffer in the name of past NPAs," it said.Risk aversion by banks has been a major concern of late as credit and liquidity are the need of the hour amid the Covid-19 pandemic.The Reserve Bank of India's latest Financial Stability Report said that heightened risk aversion has pulled the overall credit growth rate of scheduled commercial banks to 5.9 per cent on a year-on-year (y-o-y) in March 2020."Bank credit, which had considerably weakened during the first half of 2019-20, slid down further in the subsequent period with the moderation becoming broad-based across bank groups," the report said.During the discussion on Wednesday, the Prime Minister noted that the government is firmly behind the banking system and is ready to take any steps necessary to support it and promote its growth."Banks should adopt fintech like centralised data platforms, digital documentation and collaborative use of information to move towards digital acquisition of customers. This will help increase credit penetration, increase ease for customers, lower costs for banks and also reduce frauds," the statement said.It was stressed that India has built a robust, low cost infrastructure which enables every Indian to undertake digital transactions of any size with great ease and banks and financial institutions should actively promote the use of RUPAY and UPI among its customers.Further, the Prime Minister also reviewed the progress of schemes like emergency credit line for MSME, additional KCC cards, liquidity window for NBFC and MFI."While it was noted that significant progress has been made in most schemes, banks need to be proactive and actively engage with the intended beneficiaries to ensure that the credit support reaches them in a timely manner during this period of crisis," the statement said.IANS New Delhi For Latest Updates Please-

Join us on

Follow us on

172.31.16.186