Gallery

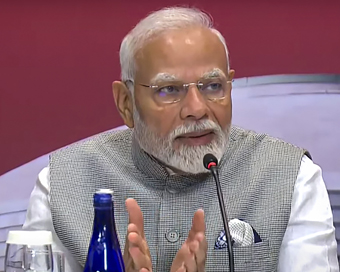

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)The Badminton Association of India (BAI) has announced a 14-member-strong India squad for

- Men’s Sr Hockey Nationals to be played in division-based format from April 4

- Mensik denies Djokovic 100th title in Miami final

- KIPG: Son of a vegetable vendor, Bihar’s Jhandu Kumar eyes Worlds, 2028 Paralympics

- Hardik Singh credits hard work and team unity for receiving HI Midfielder of the Year award

- Djokovic, Alcaraz land in same half of Miami draw

RBI keeps repo rate unchanged at 4 percent Last Updated : 05 Feb 2021 12:20:01 PM IST

RBI Governor Shaktikanta Das Adopting a wait and watch approach, the Reserve Bank retained its key short-term lending rates along with the growth-oriented accommodative stance during the final monetary policy review of FY21.

Accordingly, the Monetary Policy Committee (MPC) of the central bank voted to maintain the repo rate, or short-term lending rate, for commercial banks, at 4 per cent.Likewise, the reverse repo rate was kept unchanged at 3.35 per cent, and the marginal standing facility (MSF) rate and the 'Bank Rate' at 4.25 per cent.It was widely expected that the Reserve Bank's MPC will hold rates.Announcing the MPC decision on a virtual platform, RBI Governor Shaktikanta Das gave a stable near term outlook on inflation.The inflation rate, he said is seen at 5.2 per cent in Q4FY21.However, rising petroleum and raw materials costs was pointed out as a source of concern.On the growth front, Shaktikanta Das said the outlook has improved significantly with positive impulses becoming more broad based.Besides, he mentioned the ongoing vaccination drive, expanding number of normalising sectors and reviving consumer confidence.Additionally, he said the GDP growth has been projected at 10.5 per cent in FY22.IANS Mumbai For Latest Updates Please-

Join us on

Follow us on

172.31.16.186