Gallery

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)The Badminton Association of India (BAI) has announced a 14-member-strong India squad for

- Men’s Sr Hockey Nationals to be played in division-based format from April 4

- Mensik denies Djokovic 100th title in Miami final

- KIPG: Son of a vegetable vendor, Bihar’s Jhandu Kumar eyes Worlds, 2028 Paralympics

- Hardik Singh credits hard work and team unity for receiving HI Midfielder of the Year award

- Djokovic, Alcaraz land in same half of Miami draw

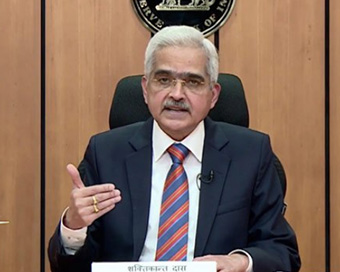

Growth Oriented: RBI keeps repo rate unchanged, retains its accomodative stance Last Updated : 04 Jun 2021 11:01:10 AM IST

RBI Governor Shaktikanta Das The Reserve Bank of India has retained its key short-term lending rates along with the growth-oriented accommodative stance during the second monetary policy review of FY22.

Accordingly, the Monetary Policy Committee (MPC) of the central bank voted to maintain the repo rate, or short-term lending rate, for commercial banks, at 4 per cent.Likewise, the reverse repo rate was kept unchanged at 3.35 per cent, and the marginal standing facility (MSF) rate and the 'Bank Rate' at 4.25 per cent.It was widely expected that MPC would hold rates and the accommodative stance.As of now, India suffers from a massive spike in Covid-19 infections.Consequently, the situation has forced state governments to implement local lockdowns and travel restrictions which have started to slowdown economic activity.This trend has impacted economic activity.Accordingly, the RBI revised India's FY22 growth estimates to 9.5 per cent from 10.5 per cent.Besides, he said vaccination process should help to normalise economic activity.Furthermore, the RBI pegged retail inflation for FY22 CPI-based inflation at 5.2 per cent.IANS New Delhi For Latest Updates Please-

Join us on

Follow us on

172.31.16.186