Gallery

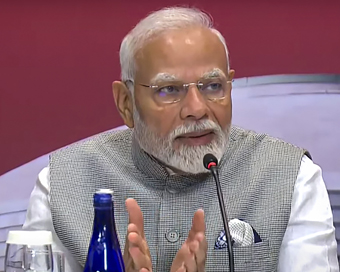

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)The Badminton Association of India (BAI) has announced a 14-member-strong India squad for

- Men’s Sr Hockey Nationals to be played in division-based format from April 4

- Mensik denies Djokovic 100th title in Miami final

- KIPG: Son of a vegetable vendor, Bihar’s Jhandu Kumar eyes Worlds, 2028 Paralympics

- Hardik Singh credits hard work and team unity for receiving HI Midfielder of the Year award

- Djokovic, Alcaraz land in same half of Miami draw

Union Budget 2022: Tax rebates in Budget for realty vital for salaried class Last Updated : 17 Jan 2022 02:35:36 PM IST

Currently, one-third of India's population reside in cities and it is estimated to go up to 50 per cent by 2030. There is a steady rise in the number of households with a shift towards nuclear families and increased urbanisation.

The 66 per cent young population - below 35 years of age, are emerging as young millennial borrowers of home-loans. It is also true that home-loans market is driven by young borrowers within the age group of 26-35 years - about 25 per cent and also by people in the age group of 36-45 years - about 28 per cent. These are all active home-loan audience and jointly account for 53 per cent of annual originations.The average ticket size of a home-loan of young borrowers has continued to increase over the last 5 years, with a CAGR of 6.2 per cent. The ticket size continues to increase more for women than men. The cumulative active home-loan base of these borrowers has seen continuous growth over the last 3 years at a CAGR of 3.5 per cent.These young borrowers have been the reason for change in the home-loan market.Within the affordable segment, volume growth in home-loans of Rs 15-35 lakh, over the last 4-5 years, indicate shifting preferences of buyers towards higher ticket sizes. Rural Housing demand for mid-range and higher ticket sizes has continued to increase over the last 5 years too. Share of annual originations (volume) of Rs 35-75 lakh ticket size has increased by 4 per cent in the last 5 years. Share of annual originations of Rs 75 lakh plus ticket size has increased from 0.37 per cent to 0.87 per cent in the last 5 years.Share of annual originations of Rs 15 lakh ticket size has declined over the last 5 years, largely due to falling demand for very small ticket size segment of Rs 2 lakh.The dearth of disposable income has been a deterrent factor for salaried class towards taking home-loan and buying real-estate. Since the input cost in real-estate has increased the rates, the salaried class is left with no other option but to approach for home-loans from financial institutions. Interestingly, the tenure of repayment of home-loan is fluctuating between 11-30 years.There is also a deterrent factor for salaried class in home-loans and EMIs. The EMIs are no more supportive since the financial institutions first draw larger part of interest in the EMIs and principal component is kept less in more than first 50 per cent of the EMIs. As the EMIs near completion, the interest component becomes negligible and principal component is much higher.Even if the buyer has the provision of pre-payment of home-loan, he ends up paying the larger portion of principal amount rather than saving on the interest. Further, the financial institutions also levy heavy fees on pre-closure of loans. In case the buyer opts for higher tenure for loan repayment, it then makes it difficult for the buyer to invest in second property.One question that has been asked frequently is - "If the principal and interest amount are predefined, why the EMIs can't have equal amount throughout the tenure."Coming to tax benefit, repayment of principal amount in a home-loan qualifies for deduction under section 80C, which has an upper limit of Rs 1.50 lakh per annum. Since the same section - 80C, accounts a number of other investments including PF, PPF and life insurance policies etc, it becomes impossible for a buyer to take advantage of any benefit out of this section.Buyers are looking forward to increase in this limit in Union Budget-2022 since this limit has not been increased in last many years.On the tax benefit for interest payment, since under section 20(b) of the Income Tax Act, there is a cap of Rs 2 lakh per annum on the interest part of the home-loan, home-loans being larger in size, the buyers are unable to take much benefit of the same too. To extend tax benefit to the buyers the government has also added few sub-sections 80EE, 80EEA under the Income Tax Act but the volume of loan is not allowing buyers to gain desired additional benefits out of these sub-sections.What perhaps needed in the Union Budget 2022 is to bring dynamic changes in the income-tax slabs and increase the rebates under section 80C, 80EE, 80EEA and 24(b) of the Income Tax Act.One of the greatest philanthropists Andrew Carnegie said - "Ninety percent of all millionaires become so through owning real-estate." Andrew Carnegie is one of the five people who built America, the other four being Cornelius Vanderbilt, John D. Rockefeller, J.P. Morgan, and Henry Ford. Harv Eker, an author and businessman, known for his theories on wealth and motivation said - "Don't wait to buy 'real-estate', buy real-estate and wait". These two statements said all about owning real-estate and what it could mean to a buyer.Globally, investment in real-estate is directly related to the future of a buyer and also growth of the economy, and so be in India.IANS New Delhi For Latest Updates Please-

Join us on

Follow us on

172.31.16.186