Gallery

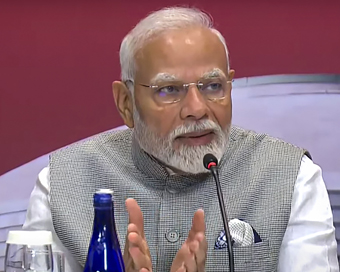

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)The Badminton Association of India (BAI) has announced a 14-member-strong India squad for

- Men’s Sr Hockey Nationals to be played in division-based format from April 4

- Mensik denies Djokovic 100th title in Miami final

- KIPG: Son of a vegetable vendor, Bihar’s Jhandu Kumar eyes Worlds, 2028 Paralympics

- Hardik Singh credits hard work and team unity for receiving HI Midfielder of the Year award

- Djokovic, Alcaraz land in same half of Miami draw

Stock Market Today: Nifty around 16,600; auto, metals shine, Sun Pharma top loser Last Updated : 31 May 2022 10:43:00 AM IST

Indian equity benchmark indices were lower in opening deals on Tuesday ahead of the release of India's gross domestic product (GDP) numbers for the fourth quarter of fiscal FY22.

Investors await GDP figures to gauge fresh cues. The GDP figures are expected this evening at around 5.30 p.m.

At 10.03 a.m., sensex was at 55,597 points, down 328 points, whereas nifty at 16,585 points, down 76 points."The dominant factor determining the market direction, going forward, would be the trend in the US market, which, in turn, would be determined by the inflation in the US and the Fed's response to it," said V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services.A major headwind for the Indian economy and markets is crude spiking above $120 per barrel over EU sanctions on Russian oil, said Vijayakumar.Official data for Q4 GDP for India is likely to register at 2.7 per cent, and for the entire fiscal FY22 at 8.5 per cent, said Deepak Jasani, Head of Retail Research, HDFC Securities.IANS Mumbai For Latest Updates Please-

Join us on

Follow us on

172.31.16.186