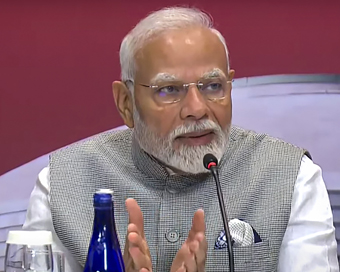

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)The Badminton Association of India (BAI) has announced a 14-member-strong India squad for

- Men’s Sr Hockey Nationals to be played in division-based format from April 4

- Mensik denies Djokovic 100th title in Miami final

- KIPG: Son of a vegetable vendor, Bihar’s Jhandu Kumar eyes Worlds, 2028 Paralympics

- Hardik Singh credits hard work and team unity for receiving HI Midfielder of the Year award

- Djokovic, Alcaraz land in same half of Miami draw

RBI likely to leave interest rates unchanged Last Updated : 06 Jun 2024 02:07:47 PM IST

RBI likely to leave interest rates unchanged The RBI is expected to leave interest rates unchanged in its monetary policy review as it continues to maintain a balance between pushing for economic growth and keeping inflation in check.

The RBI’s Monetary Policy Committee (MPC) meeting being held from June 5 to 7, which is taking stock of the economic situation, is expected to stick to the current 6.5 per cent repo rate.

The repo rate is the interest rate at which the RBI gives short-term loans to banks to enable them to meet their liquidity requirements. This in turn has an impact on the cost of loans that banks extend to corporates and consumers.

A cut in interest rates results in more investment and consumption expenditure which spurs economic growth. However, the increased expenditure also pushes up the inflation rate as the aggregate demand for goods and services goes up.

RBI Governor Shaktikanta Das has stated that the central bank would continue with its disinflationary policy to ensure a stable growth path for the economy. He said food price inflation continues to weigh on the trajectory going ahead.

The RBI had last changed rates in February 2023, when the repo rate was hiked to 6.5 per cent. The RBI raised rates by 2.5 per cent between May 2022 and February 2023 after which they have been kept on hold to support economic growth despite inflationary pressures in the past.

The country’s annual retail inflation eased to 4.83 per cent in April but is still above the RBI’s medium-term target rate of 4 per cent. The fact that the economy has clocked a robust growth rate of 8.2 per cent for 2023-24 leaves the RBI with headroom to put off an interest rate cut until inflation comes down to its targeted level, according to economists.IANS Mumbai For Latest Updates Please-

Join us on

Follow us on

172.31.16.186