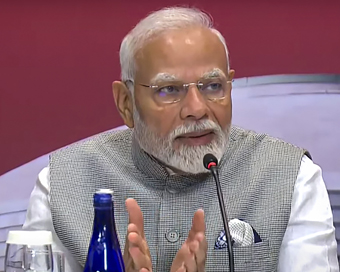

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)The Badminton Association of India (BAI) has announced a 14-member-strong India squad for

- Men’s Sr Hockey Nationals to be played in division-based format from April 4

- Mensik denies Djokovic 100th title in Miami final

- KIPG: Son of a vegetable vendor, Bihar’s Jhandu Kumar eyes Worlds, 2028 Paralympics

- Hardik Singh credits hard work and team unity for receiving HI Midfielder of the Year award

- Djokovic, Alcaraz land in same half of Miami draw

Growth outlook across sectors remains robust in India: Report Last Updated : 13 Aug 2024 12:18:26 PM IST

Growth outlook across sectors remains robust in India: Report The growth outlook across sectors remains robust in India, especially in the industrials and capex segments, where government spending remains strong, a report showed on Tuesday.

Most companies remain constructive on long-term growth and see this as a sustained spell of growth and these seem to be little sign of any cyclical pressure, according to the report by Emkay brokerage firm launched at its event.

Industrial companies are seeing a continuously robust operating environment as there has been no material change in government spending momentum, order book growth or demand momentum, and the medium-term demand outlook remains strong, the findings showed.

Costs are also largely under control and the recent softness in commodity prices could help, it added.

“Most companies have seen no revision in capex plans in the recent past, and there is an upward momentum across most industrial companies,” the report noted.

There is a slight softness in asset quality that could drive an upward normalisation of credit costs.

Rajeev Chaba, CEO Emeritus at JSW MG Motor, said that the thrust of policymakers is to enable the local supply chain, to help meet the objectives of multiple stakeholders.

The objectives are to reduce the national crude import bill and dependence on China for EV supplies, higher localisation to bring down costs for customers and support local manufacturers, he mentioned.

According to Ashish Bharat Ram, Chairman, SRF, the India chemical industry has given massive total shareholder returns compared to European innovators or Chinese producers, owing to its lower base and shift of manufacturing away as part of the China + strategy of the companies.

The government’s fiscal deficit has declined to 8.1 per cent of the full-year estimate in the first quarter of the current financial year, compared with 25.3 per cent during the same period in the previous year. The fiscal deficit stood at Rs 1.36 lakh crore at the end of June.

Overall, the government has spent 20 per cent of its total expenditure of Rs 48.2 lakh crore budgeted for the current fiscal. The capex spending has been kept unchanged at Rs 11.11 lakh crore to spur growth.IANS New Delhi For Latest Updates Please-

Join us on

Follow us on

172.31.16.186