Gallery

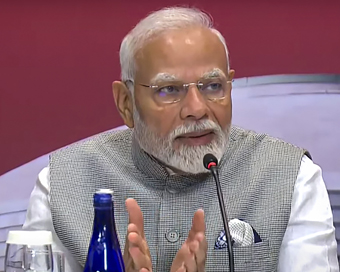

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)The Badminton Association of India (BAI) has announced a 14-member-strong India squad for

- Men’s Sr Hockey Nationals to be played in division-based format from April 4

- Mensik denies Djokovic 100th title in Miami final

- KIPG: Son of a vegetable vendor, Bihar’s Jhandu Kumar eyes Worlds, 2028 Paralympics

- Hardik Singh credits hard work and team unity for receiving HI Midfielder of the Year award

- Djokovic, Alcaraz land in same half of Miami draw

ED arrests PISL MD Vuppalapati Satish Kumar in Rs 3,316 crore bank fraud case Last Updated : 19 Aug 2021 12:06:49 PM IST

The Enforcement Directorate (ED) has arrested Vuppalapati Satish Kumar, MD of Prithvi Information Solutions Limited (PISL) in connection with Rs 3,316 crore bank fraud case.

An ED official said that it arrested Kumar on August 12 and got his custody till August 18.The official said that Kumar was arrested under the Prevention of Money Laundering Act (PMLA) for causing a loss of around Rs 3,316 crore to a consortium of public sector banks in connivance with Hima Bindu B, MD of VMC Systems Limited.Bindu, sister of Kumar was arrested by ED on August 5 this year.An ED official said that the financial probe agency initiated a money laundering investigation on the basis of an FIR filed by the CBI against the company.He said that VMCSL had taken loans from a consortium of banks and the present dues outstanding to all the banks is Rs 3,316 crore.The ED claimed that the forensic audit revealed that the VMCSL circulated loans to various related entities to inflate its books of accounts."Forensic audit also revealed that the PISL, a related entity, was given three per cent commission amount by the VMCSL for all receipts from the BSNL without any specific role of the PISL in BSNL tenders," the official said.The official also said that forensic audit further revealed that the VMCSL had opened various Letters of Credit (LCs) worth Rs 692 crore in the name of fake or dummy entities which were subsequently devolved.He said that Kumar through his company PISL and Ennar Energy Limited and with the active assistance of his sister Hima Bindu, MD of VMCSL, in order to dodge the banks, created false or exaggerated operational revenues by generating fake sales or purchase invoices through the companies controlled by their family members.Kumar and Bindu siphoned off a part of proceeds of crime by remitting it to the overseas entities controlled by their family members, he said.Although Kumar claimed that he had no link with the NPA of VMCSL, but more than 40 Hard disks of VMCSL were recovered from his residence during the search carried out by the ED on July 20 this year."On forensic examination of digital devices, it was found that he indulged in benami transactions and involved in efforts to transfer fraud amounts to off-shore entities. He was non-cooperative during the investigation and was not supplying documents of his own business entities on one pretext or the other," he said.IANS New Delhi For Latest Updates Please-

Join us on

Follow us on

172.31.16.186